The Hope of a

CRM

There is a misconception in the industry that automatically and by itself CRM = ROI. And many CRM companies even promise they will magically improve your performance, reduce the complexity of your marketing efforts, automate your sales processes, and simplify your business life just by having the right CRM.

But has that happened? Of course not.

Because a CRM by itself is a framework that you, the financial advisor and your team, must invest the thousands of hours necessary to understand and then customize to your needs.

With any CRM, you must be able to capture, record, retrieve, and USE the data that is housed in your CRM to generate any ROI. And if you or your team don’t have at least some best practices on data management, then your CRM will degrade into nothing more than a digital database of clients and probably some prospects.

It’s certainly not the goldmine you were sold.

alright, you have a crm...

now what?

There are four steps that can convert your CRM to ROI when followed. It is a law of contact management and is one of the principal best practices for pipeline management. Following this law will produce real results in both client management and lead management as well. If you’re losing prospects in your pipeline, it is likely caused by poor data management. A good CRM solution will prevent this attrition.

STEP #1

Capture

For client information to be useful, you must be able to capture it easily in a phone call or meeting. You can capture it by remembering it, making notes, gathering it from a questionnaire, or a survey, and so on. Besides surface-level data such as your client’s financial information, financial planning goals, and contact information, you’ll also need details about your client’s needs that will help you do more business with them. For example, future opportunities, real estate holdings, the names and birthdays of the spouse and heirs – the details of their lives that come up in the course of social conversation.

STEP #2

Record

With your captured data, you have to now record it somewhere. This means you associate that captured information with the individual in a household. (It is NOT a best practice to capture and record data in a single step, and we do not recommend it. While it may be convenient, typing while you talk to a client or prospect is very rude and if this is your habit, we can help you adopt a better way to do business.)

Some CRMs provide pre-built fields for this information, while other CRM platforms require customizable workarounds. We recommend that you and your team members adopt a standard method of recording data, and then repeat that process across all your records. Do NOT change what works halfway through or you will regret your life choices when you get to step three.

STEP #3

Retrieve

You may be really good at capturing and recording details about your clients and prospects, and if you are, great! You’ve got 50% of the formula down. But the next step is crucial to your ROI conversion. This step involves retrieving your information. To test the viability of this step in your current CRM, take a moment and think of your best client. In your head make a mental list of all their future opportunities, the sale of a house, a CD due, whatever it is.

You’ve got it noted somewhere, right? Of course you do.

So, here’s the test: In 34 seconds, produce a list of all your future opportunities for the next year.

Can you do it?

If no, this is where your CRM-to-ROI conversion breaks down. If you cannot quickly access the data in your CRM, you are better off going back to a Rolodex. You have all the data, but no ability to easily retrieve it. Thus, your formula ends, and your CRM will NEVER produce the expected ROI.

This is not your fault, or the fault of your advisory firm, or your team members. Most financial CRM software just isn’t user-friendly, with functionalities that aren’t created with user experience in mind. It is the inherent complexity of a CRM built by engineers who have never fully run a marketing campaign or thought about how to keep quality leads in their sales pipeline. Ever. And probably never will. Because they are engineers. Not marketing people. Not salespeople. And definitely not financial advisors.

STEP #4

use

If you are able to rapidly retrieve data in your CRM (key word: RAPIDLY), then you are probably in the very small category of sophisticated computer users. The fourth and final step in the CRM-ROI conversion lies in how you USE YOUR DATA. This data is the pay dirt in your CRM goldmine.

Your ability to properly categorize, systematize, organize, and utilize this treasure determines the value of your book and your business. It is really that important.

We recently coached a financial advisor’s office who kept their opportunities in their planning software. The data was certainly captured, recorded, and retrievable. But it wasn’t very actionable, meaning it took a lot of effort to be able to analyze what was coming due. So, we went to their office and reorganized a few things, implemented many of our best practices in data management, and made it possible for the Advisor to use the information.

Do you know what we found there? Opportunities worth over $120M in new assets.

So, how did we use that information? We targeted those clients with a campaign we designed to move outside assets in-house. They are still sweeping up that pay dirt from this digital goldmine, and so far it has been quite profitable for them. Just as it can be for you.

Why

Gorilla 5?

Gorilla 5 is built by people who have decades of experience in running effective marketing campaigns for the financial services industry, and not by engineers with none. We have run and managed a multitude of marketing channels, such as email marketing, social media marketing, referral marketing, and many more. We understand what it takes to convert a prospect to a new client, and then from a client to a raving fan. We know the systems needed to manage a small business that can assist with client onboarding, build client engagement, create client retention, and automate seminar follow-up. And then when the market turns volatile, it can send a calming message about what just happened in just a few clicks.

In short, we understand the client lifecycle in its entirety.

And THAT lifecycle into a pipeline management tool that we call Gorilla 5.

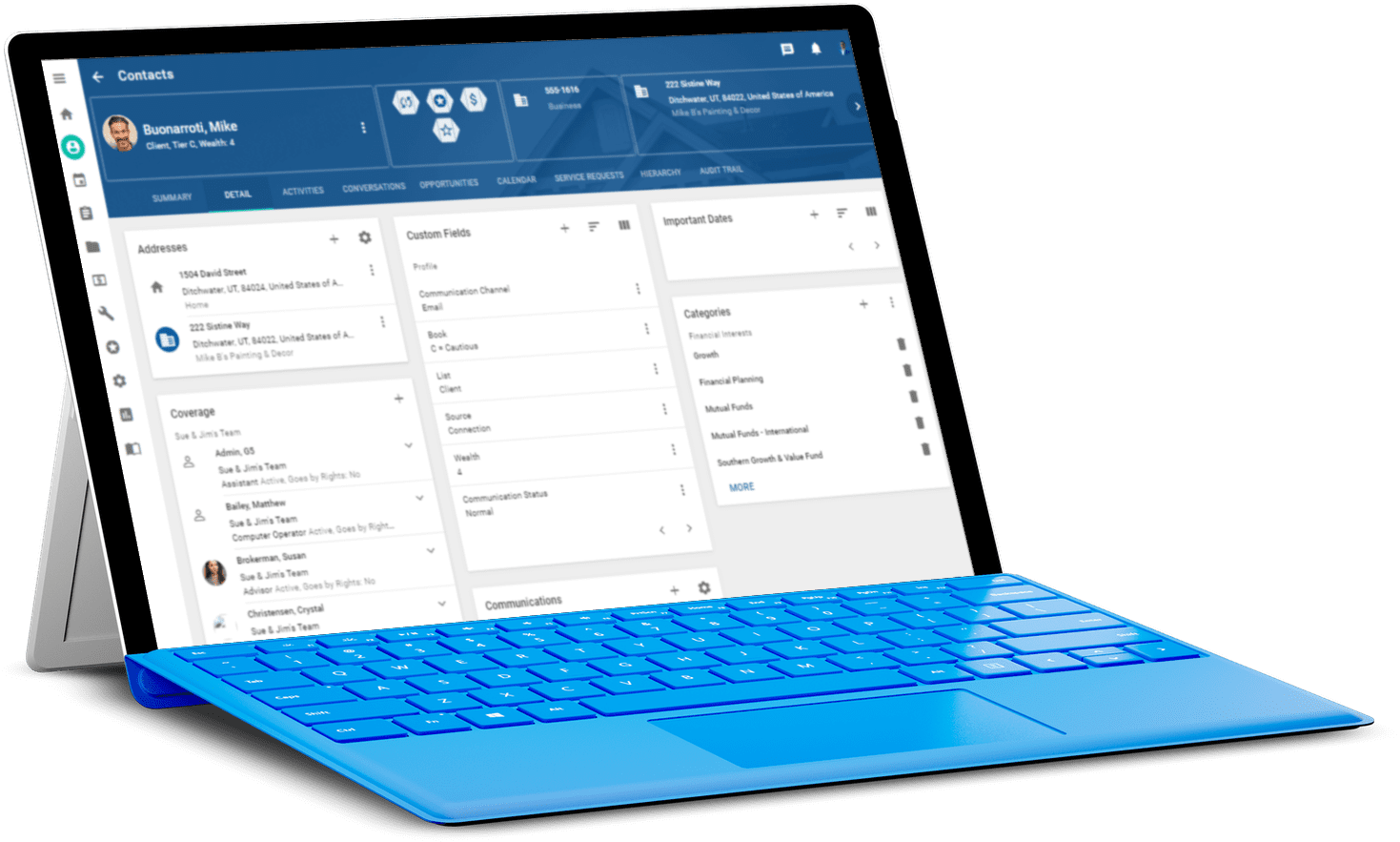

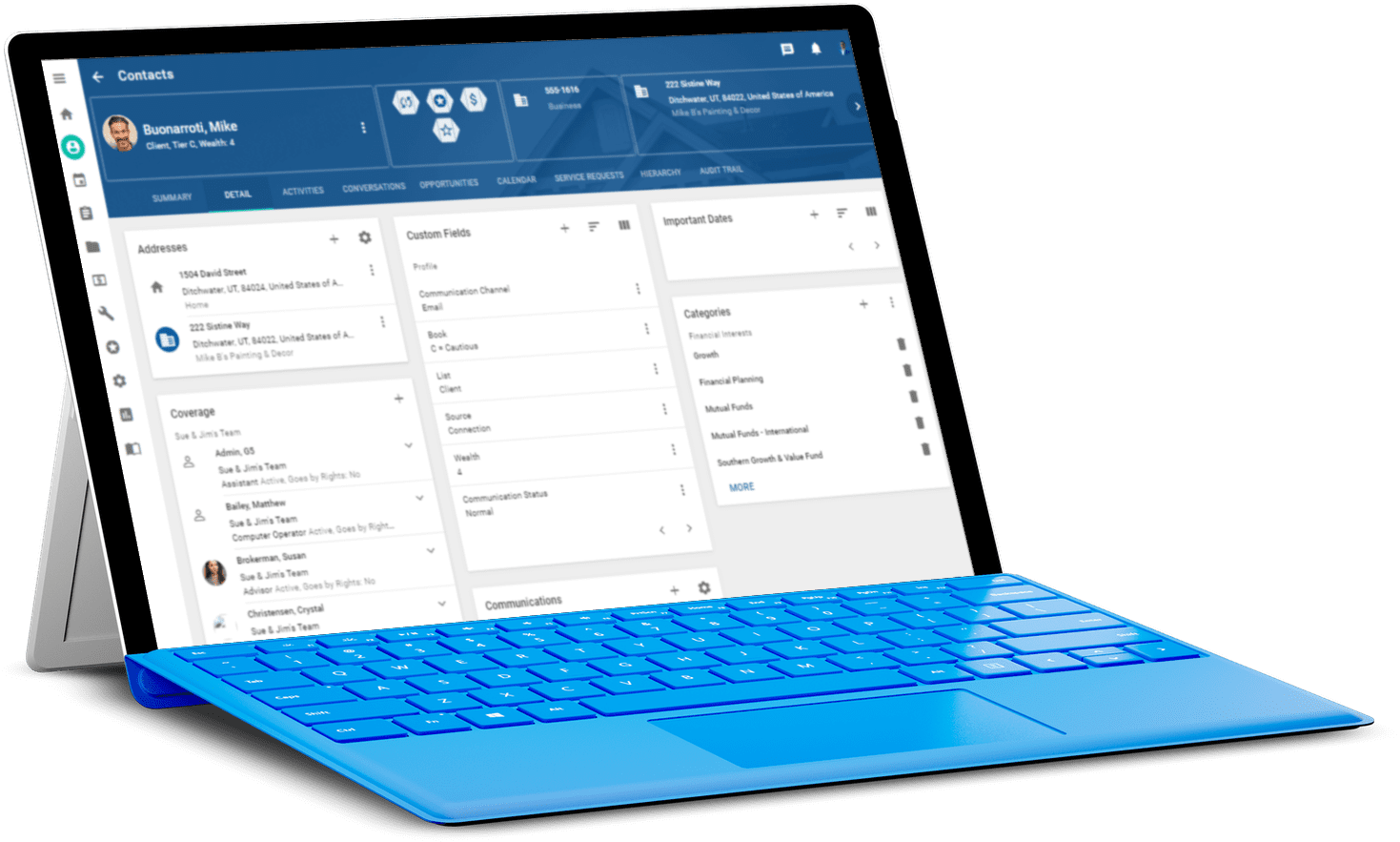

As one of the best CRMs for financial advisors, it is cutting-edge technology that combines templates and automation tools with laws of contact management to streamline your team’s workflow, automate your routine processes, and ultimately helps you grow.

Templates and

automations

The Gorilla 5 CRM helps everyone in your practice strengthen your client relationships on autopilot, including your customer support, marketing, and sales teams. Gorilla 5 optimizes your routine business processes and can be run and re-run with a few mouse clicks. In less than an hour, your first marketing campaign is set up and ready to go. Once you’re through our training on data management and complete the data purification process, the pipeline management tools will seamlessly integrate your sales process into your CRM. And that magic ROI conversion begins.

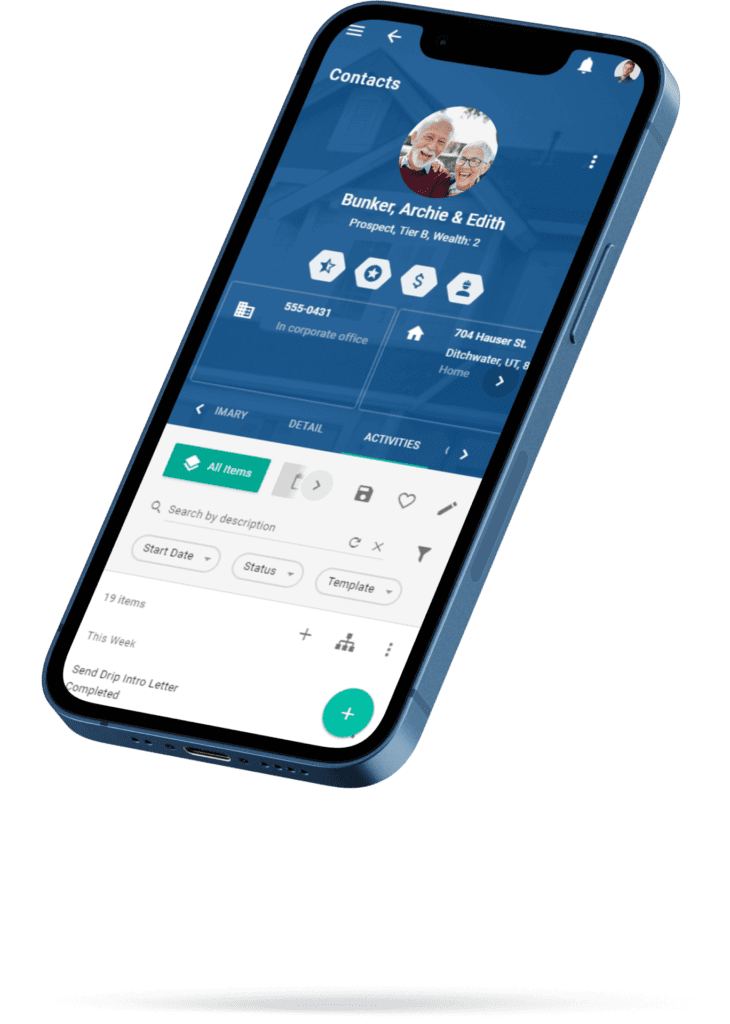

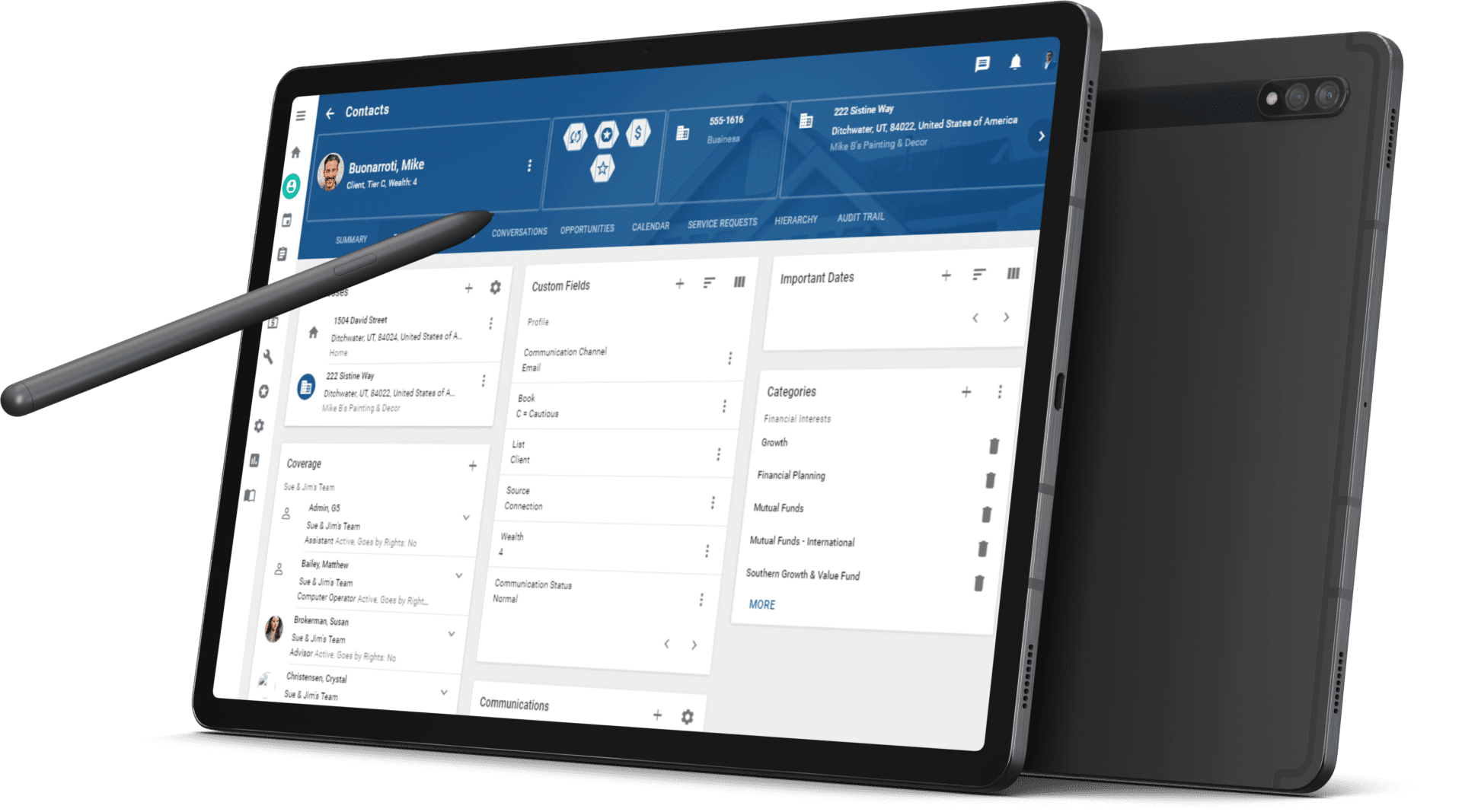

An industry legend

Reborn

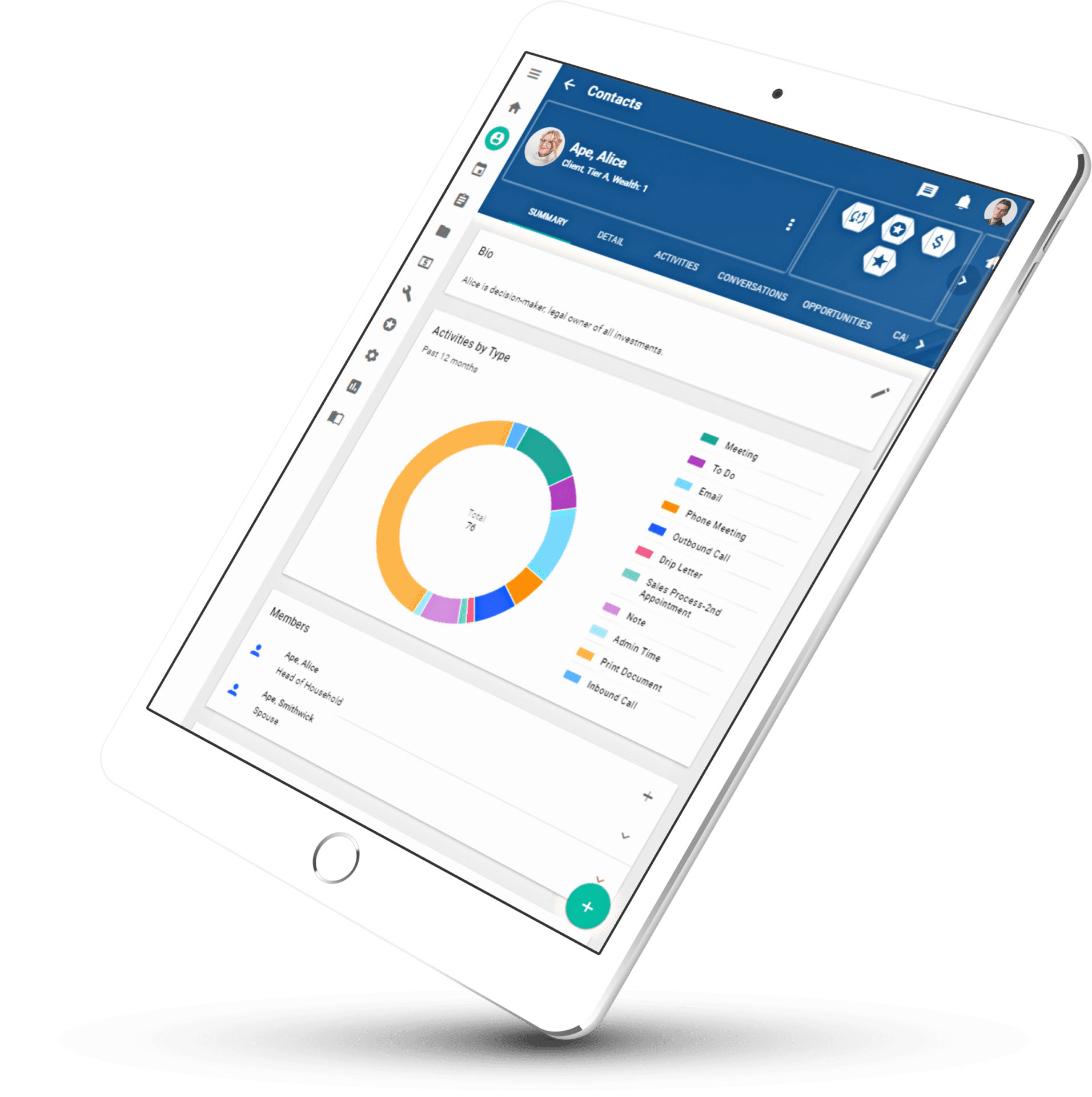

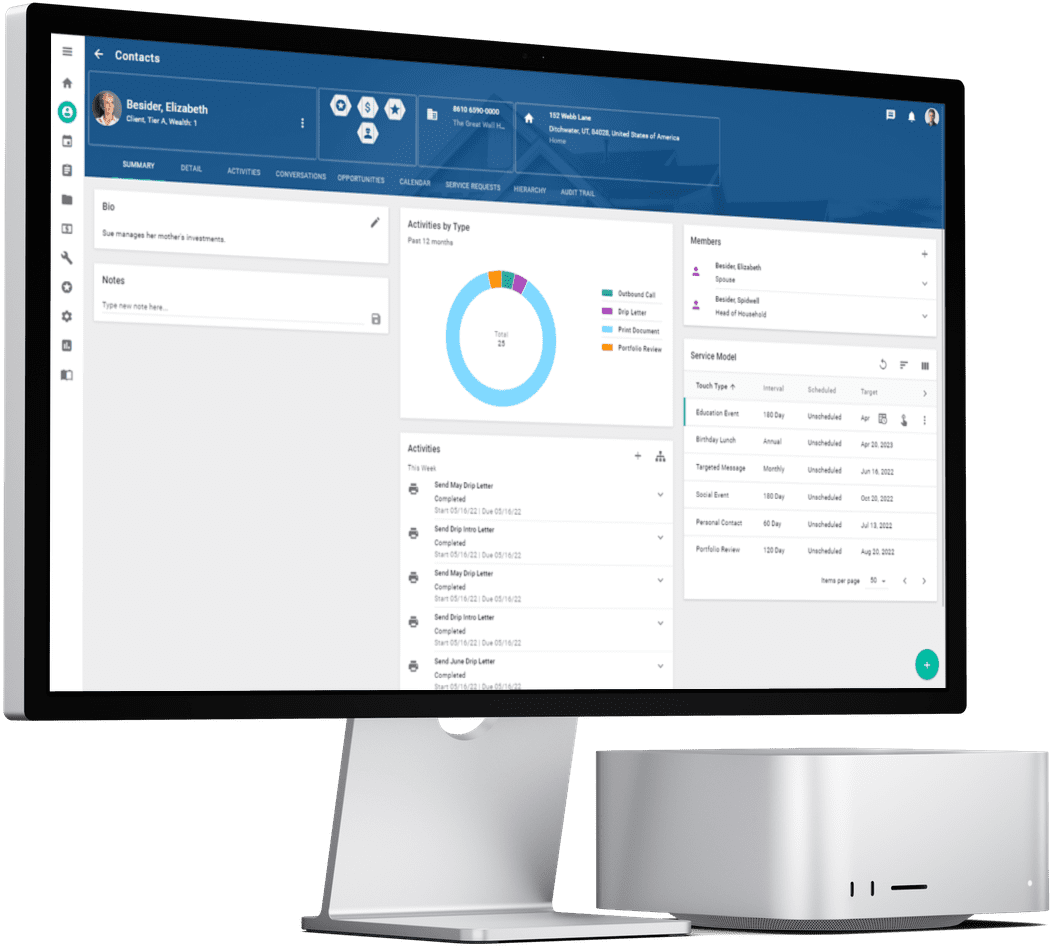

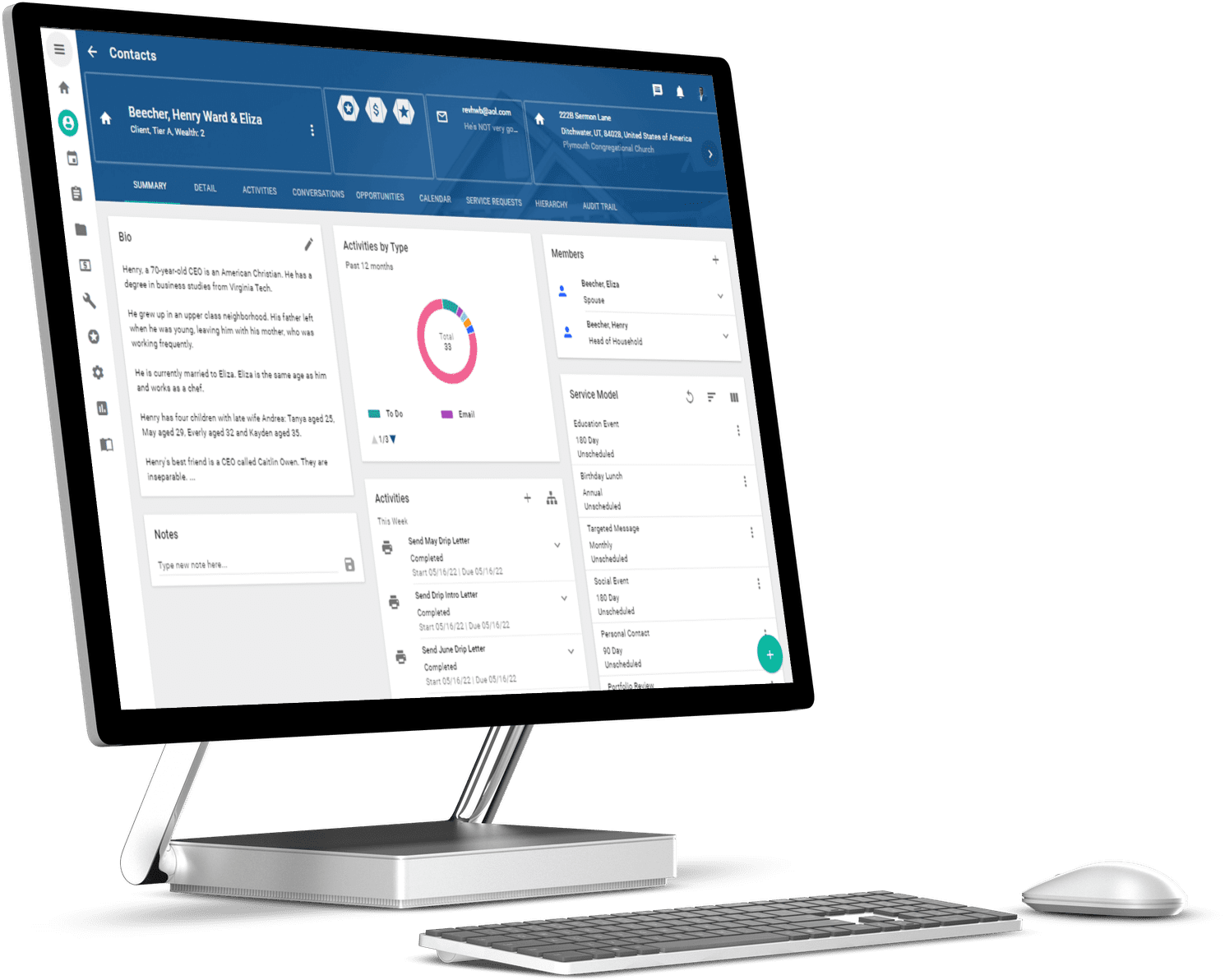

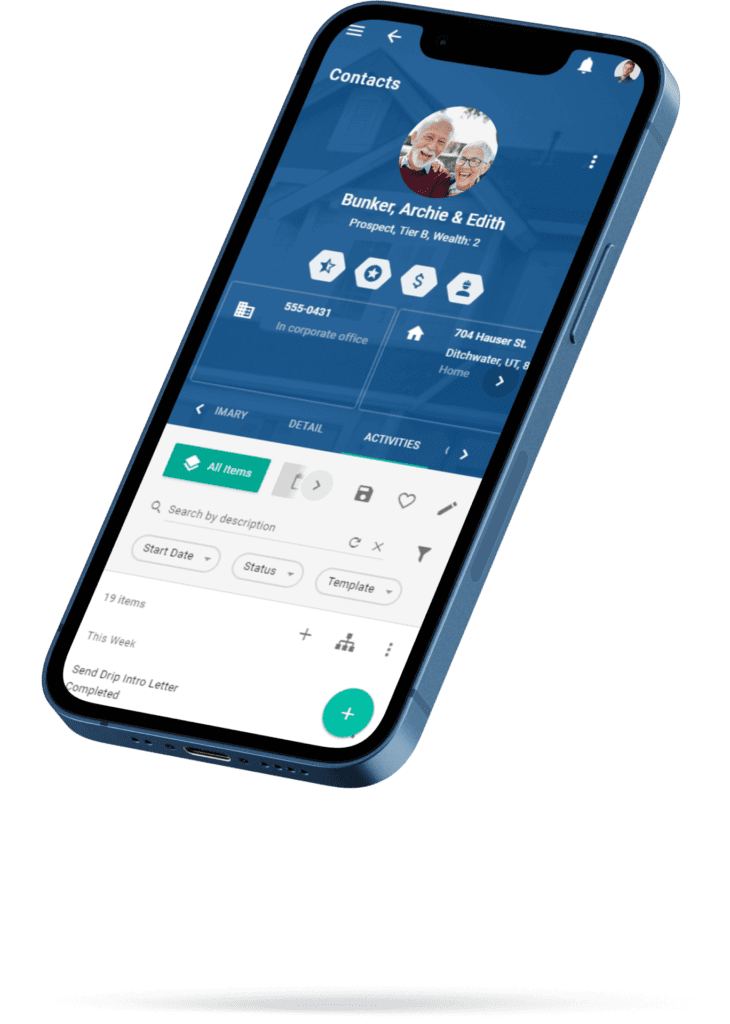

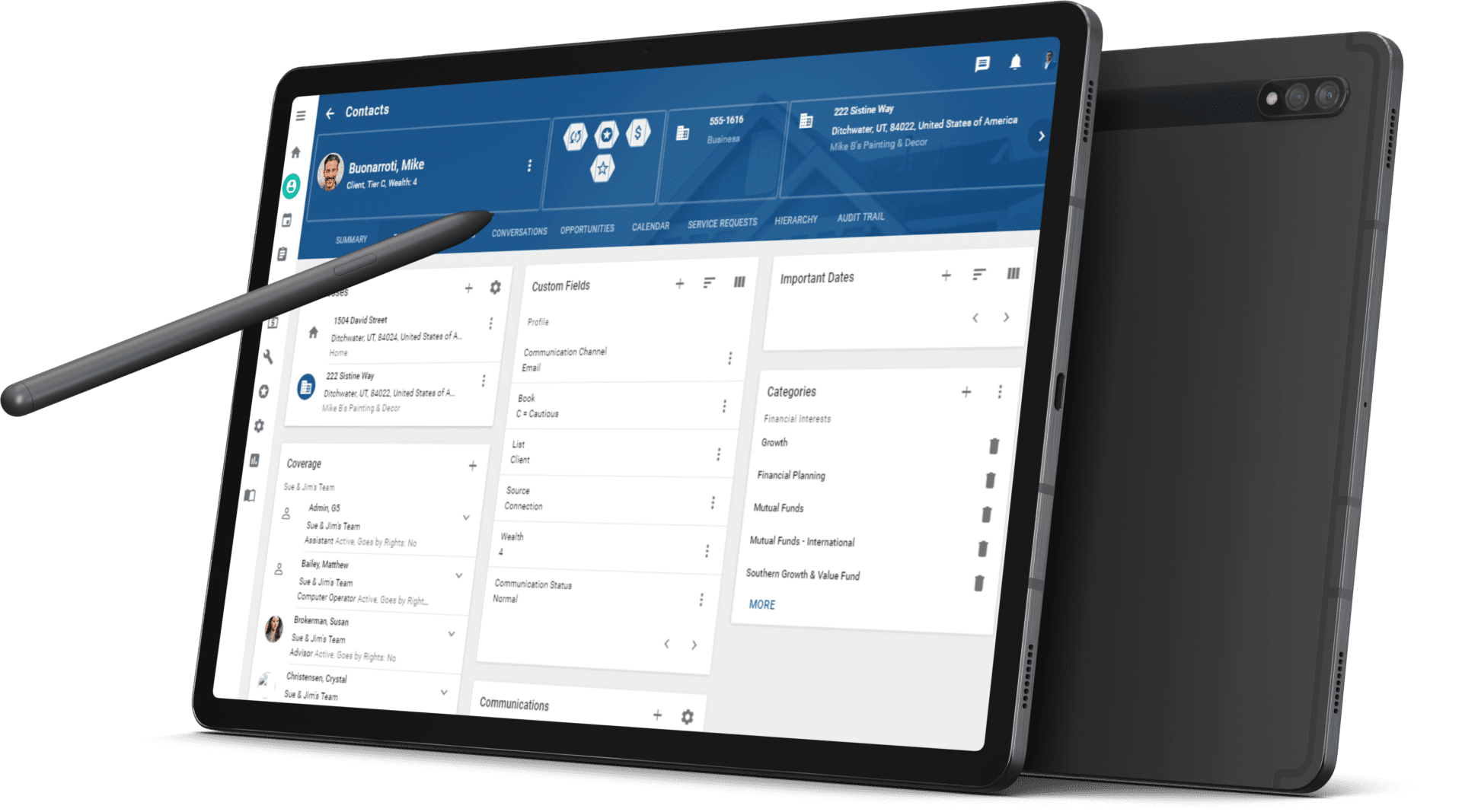

Gorilla 5 is OS Independent, regardless of your device (desktop, laptop, tablet, or phone), all your information is available wherever you are. Its ease of use enables you to do more with what you already have. With more than 40 years of experience and industry best practices, we know growth and retention. With the cutting-edge technology built out of that experience, we make it possible to grow consistently, efficiently, and rapidly. We routinely create ROI from CRM.

FROM THIS GENERATION

to the next

We drive the future. With AI rapidly evolving, our plans incorporate the next generation of AI-driven tools that will help you automate and optimize that much more.

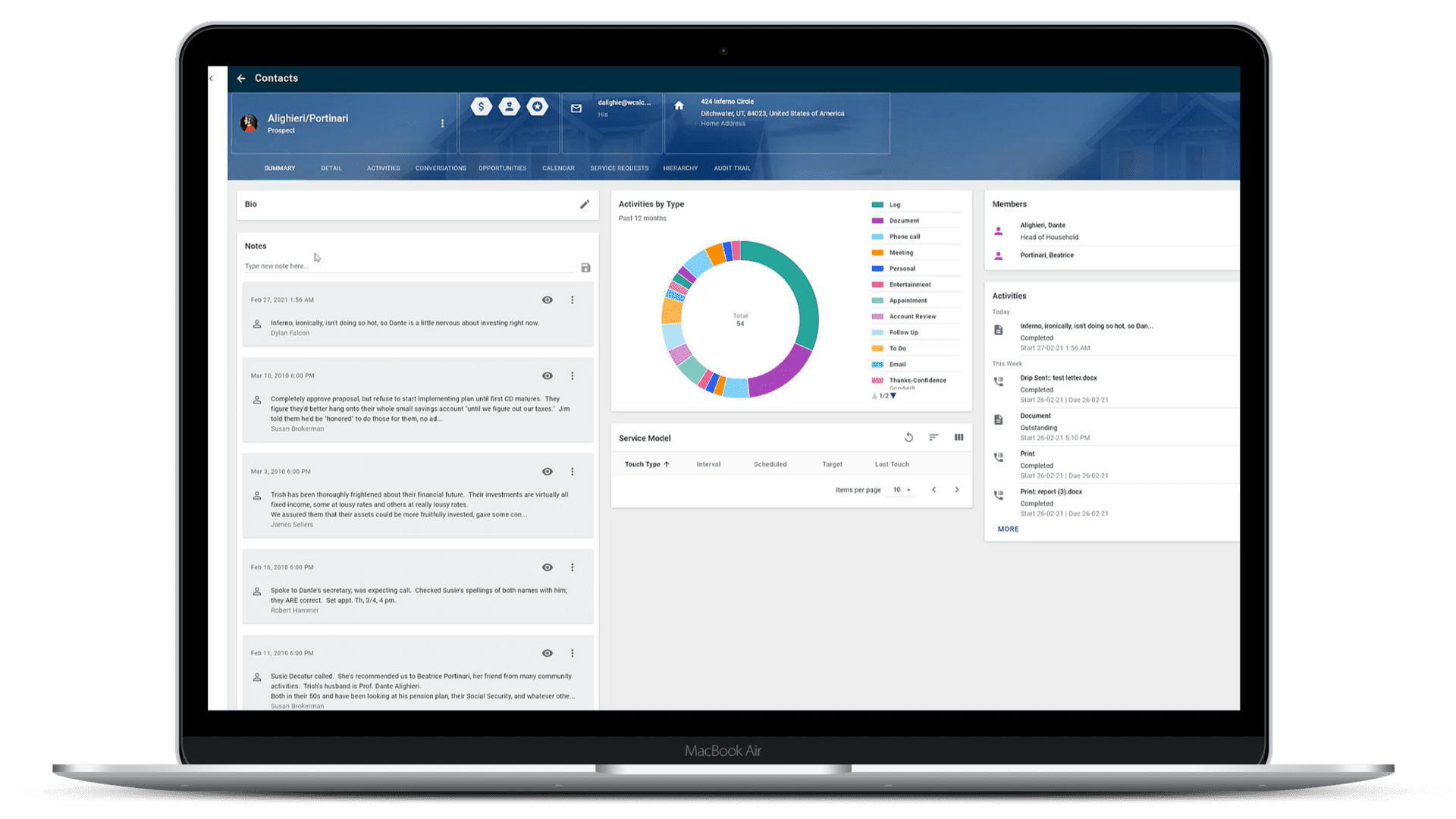

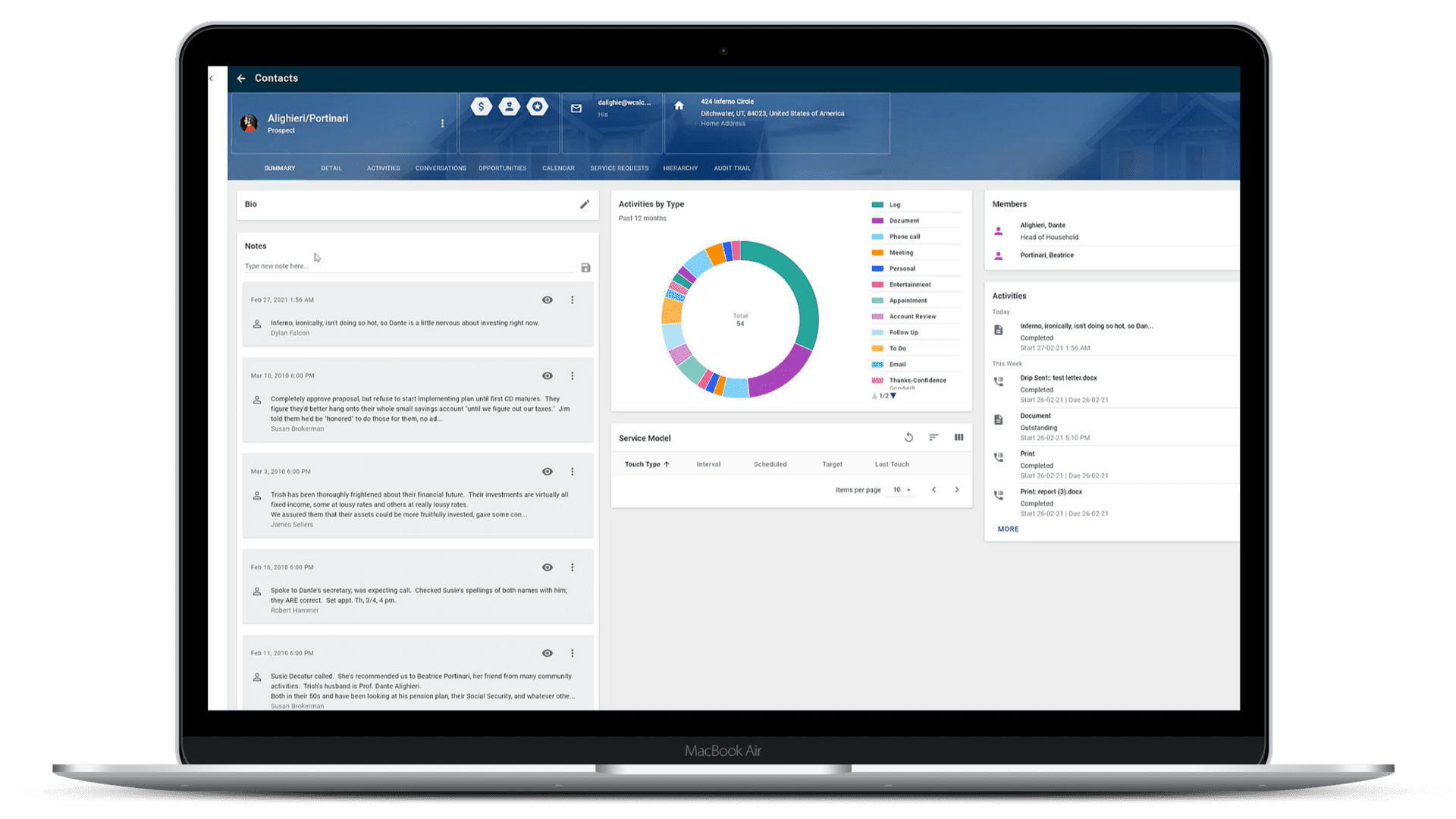

new Customer View

360°

Interested in finding out more about how Gorilla 5 can help you?

Give us a call and we’ll go over customization, integrations, and pricing.

- Guided personal tour via web-conference.

- Takes about 30 Minutes, with Q&A.

- Experience the true power of Gorilla 5 live.