Marketing Simplified. Results Amplified.

High-quality, compliance-friendly market updates, holiday messages, infographics, and newsletters that people actually want to read (and share with friends and family). All sent for you, every week of the year.

Trusted by

Top Companies

The only marketing solution you need to…

Stand Out From

the Rest

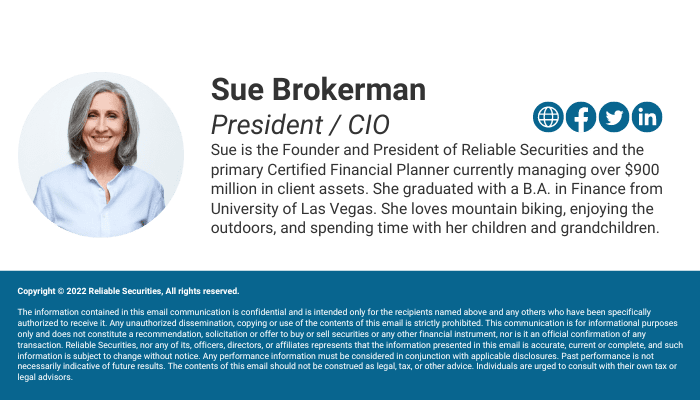

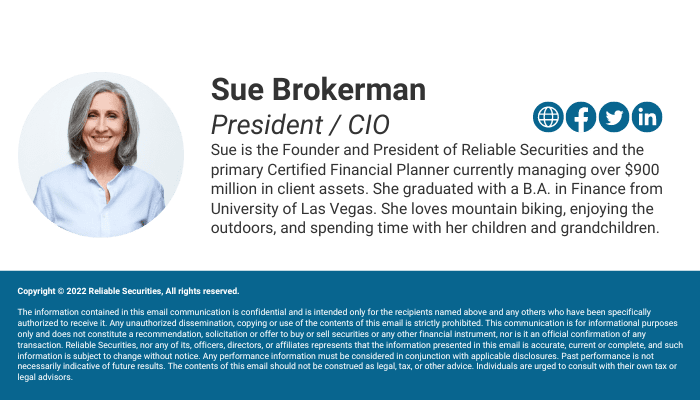

Presence positions you as both an expert financial professional in your field and a person who truly cares about your clients and your community.

The result: In a sea of lookalikes all selling the same thing, you stand out as the one financial advisor who’s here to help.

Always Be Top of Mind with Potential Clients

With timely, valuable content sent every week, prospects will always think of you first the moment they need financial advice.

The result: More first appointments, lower unsubscribe rates, and an increase in assets under management!

Turn Ideal Clients into

Raving Fans

With engaging, must-read market commentary and warm, can’t-wait-to-share-this holiday messages, your current clients will look forward to hearing from you, knowing it will be both helpful and interesting to them.

The result: More assets, more referrals, more business development opportunities, more everything.

Save Time for

Financial Advice

Presence is a completely done-for-you service that can handle ALL your marketing strategies, including your emails, your monthly drip, and even your social media marketing.

The result: You and your team can focus less on promoting your financial services to clients and prospects, and more time meeting with them. And you can track this result in your bottom line!

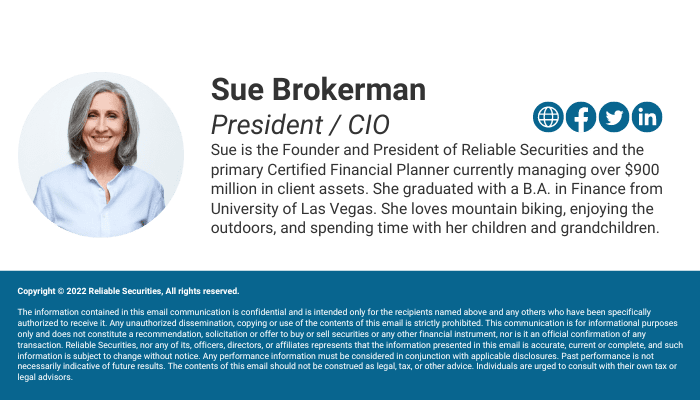

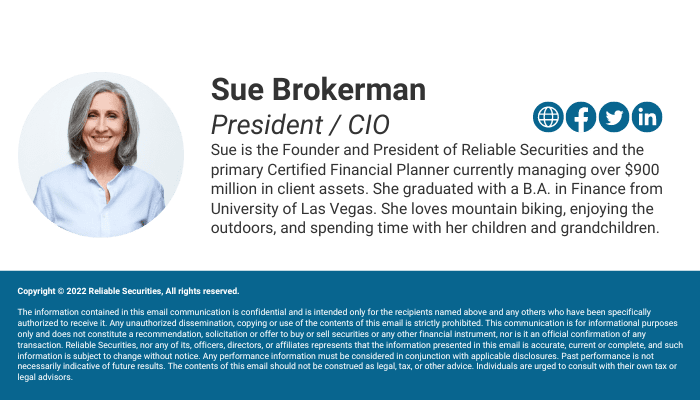

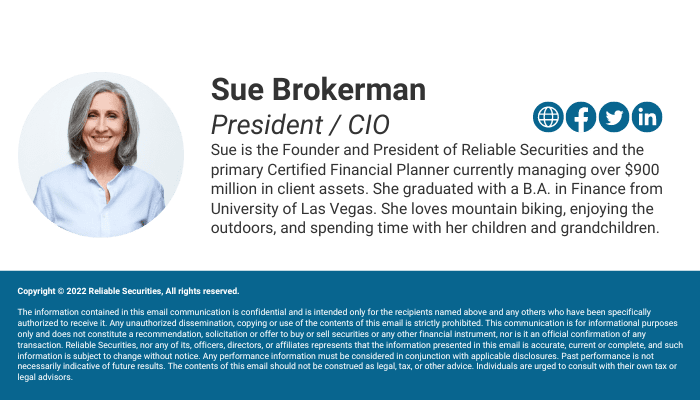

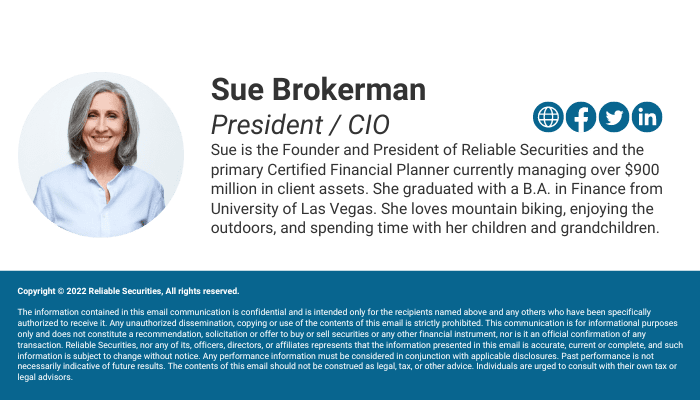

“I think any financial advisor, anywhere, is being penny-wise and pound-foolish if they do not get with Bill Good Marketing.

The price is worth it for the content alone. Every time I think, ‘We need to send something to our clients on this,’ a message appears in our inbox the next day and the clients love them.

It’s the easiest way in the world to make yourself look smart.”

B.H. | Pennsylvania, USA

Featuring Content Your Clients & Prospects Will Love to Read (and Share)

Bill Good Marketing has been providing content to financial advisors for over 30 years…far longer than anyone else in the industry. Our words have helped thousands of advisors grow even during the worst periods of market volatility, including post- 9/11, the 2008 financial crisis, and the 2020 COVID crash. That’s because our content is always timely, always conversational, and always heartfelt. All designed to get your clients and prospects to feel impressed, grateful, inspired and confident. All designed to get your clients to see that you are an expert advisor, a good citizen, and a trustworthy, caring individual.

All designed to make you the financial advisor they trust to help them get where they want to go.

With Presence, your clients and prospects will receive…

Timely Market Content

Whenever extreme volatility strikes, or there’s major news out of Washington, investors need to be told what’s going on – and quickly.

With the content marketing strategy included with Presence, your clients and prospective clients will get the headlines explained within 24-48 hours, in a way that’s easy to understand and builds confidence. Clients will sleep easier knowing you’re always at the wheel, while prospects will increasingly turn to you for guidance and support.

Dear |First Name|,

On Thursday, February 24, after months of tension and military buildup, Russia invaded Ukraine. It’s the first major war between European nations in decades and brings significant humanitarian and economic ramifications for the entire world.

I want to assure you that my team and I have spent a lot of time analyzing the situation and how it might impact you. We’ll go over some of the details in a moment, but the most important thing for you to know is that we are keeping a close eye on everything. We remain confident in our investment strategy as well as the path to your financial goals.

Now, as you can imagine, the markets fell sharply when the world woke up to the news of invasion. In this message, I’m going to explain what effect this war is likely to have on both the global economy and on the markets. Because I’m a financial advisor, not a geopolitical expert or military strategist, I’m going to refrain from commenting on why this war is happening, even though I have my own opinions, as I’m sure you do. Before continuing, though, I do want to say that my heart goes out to the Ukrainian people. While this message will focus on the financial and economic consequences of war, nothing compares to the human cost. I earnestly hope that peace prevails as soon as possible.

Now, let’s do a Q&A about how this conflict will impact investors. These are some of the most common questions I’ve heard from clients over the past few days.

Q: Why is this conflict impacting the markets?

A: You’ve undoubtedly noticed in recent weeks how volatile the markets have been. The ultimate reason, frankly, is quite simple. War brings disruption. To production, to trade, to everything.

That’s especially true with this conflict. When it comes to the global economy, Russia and Ukraine are key players. For example, both together comprise 29% of the world’s wheat.1 Ukraine alone is one of the world’s top producers of corn, while Russia is Europe’s largest source of both oil and natural gas. Both countries also play a major role in producing minerals and metals – think copper, nickel, platinum, etc.

These are not products the world can live without. From the U.S. to China, from Germany to Ghana, we depend on these products to eat, communicate, get to work, grow crops, and even stay warm. If you think of the global economy as a big spider web, touching a strand on one end causes the entire web to vibrate – sometimes violently.

Now, there are steps both Europe and the United States can take to mitigate these issues. (More on that in a moment.) But given that we are still recovering from supply disruptions caused by the pandemic, war is the last thing the world needs right now.

Another reason this conflict is impacting the markets is because of the shock it will have on the global financial system – in the form of economic sanctions the West has started levying on Russia.

Q: What are the U.S. and European Union doing about this?

A: Before we get into what the U.S. is doing, let’s quickly cover what the U.S. is not.

This is not a war between the United States and Russia. Currently, there are no plans to send U.S. troops into Ukraine.2 While American forces have reinforced several nearby countries like Poland and Romania, these are fellow NATO members. Ukraine is not a member of NATO, which means NATO is not bound by the terms of its alliance to defend it from invasion. Instead, the U.S. will support Ukraine by providing supplies, intelligence, and logistical assistance.

Because Russia’s actions are both a violation of international law and its own pledge to respect Ukraine’s borders3, the U.S. and many other western countries have announced a number of economic sanctions.4 Some of these sanctions include:

- Asset freezes and travel bans on dozens of influential Russian politicians and business leaders.

- Restricting Russia’s access to the European Union’s financial markets.

- Halting construction of the undersea Nord Stream 2 pipeline, which was set to deliver natural gas to Germany and be a major source of new business for Russia.

- Barring Russian banks from raising money in the west or trading new debt in U.S. or European markets.

According to President Biden, these sanctions are just the first wave, with more soon to come.

Now, there’s no question that sanctions will have a major impact on Russia’s economy. When Russia forcibly annexed Crimea in 2014, the U.S. also imposed sanctions on Russia that many experts believe have stalled Russia’s economic growth dramatically. (Since 2014, Russia’s economy has grown by an average of 0.3% per year, compared to the global average of 2.3%.5) These new sanctions are likely to be even greater, with an even greater effect.

But sanctions take time, and alone won’t stop Russian forces from penetrating Ukraine. They can also be a double-edged sword.

Since World War II, Europe has become more economically intertwined to prevent another devastating conflict. (This idea was the impetus behind the European Union.) Since the end of the Cold War, Europe has also worked to make Russia a more integral economic partner. The idea was that the more East and West relied on each other for trade, the less likely war would ever break out.

While this experiment has largely been successful, there’s a downside. Trade in times of peace brings mutual gain – but nixing trade brings mutual pain. Sanctions will undoubtedly punish Russian banks and companies that depend on foreign business. But it can also hurt U.S. and European firms that rely on business with Russia. This is another reason the war is roiling the stock market.

Q: Okay, so let’s focus on what’s happening here at home. How long will market volatility last because of this?

Obviously, that’s impossible to say. Furthermore, trying to guess – and then making decisions based on a guess – is one of the worst things we as investors can do. So, we’re not going to do it!

That said, there are some interesting things to note here. First is that, historically, geopolitical crises often have a surprisingly short-lived effect on the markets. For example, take the Cuban Missile Crisis. The world has never been closer to nuclear war than during those nerve-wracking thirteen days in 1962, yet during that time, the Dow only fell 1.2%. By the end of the year, the Dow was up 10%.6

Remember when Iraq invaded Kuwait back in 1990? The Dow declined more than 18% in the immediate aftermath – only to recover completely a few months later, and indeed climb 38% over the next two years.7 Eleven years later, after the September 11 attacks, the Dow fell over 14%, but returned to normal a few months later. 7 More recently, look at Brexit. When the UK voted to leave the European Union, it took most analysts by surprise, and many predicted it would lead to a major drop in the markets. At first, it did. The vote took place on a Thursday. The next day, the Dow fell over 600 points, and then another 250 points the Monday after.8 But less than a month later, the Dow climbed to a new record high.

As you can see, while geopolitical events often seem scary to investors, their impact on the markets isn’t necessarily huge. That’s because many things impact the markets. Even something as big as war is only one ingredient in the dish.

On the other hand, financial experts like to say that “Past performance is no guarantee of future results.” So, just because history has leaned one way doesn’t mean it can’t shift course in the future. This current crisis could have a sustained impact on the markets for all the reasons we’ve discussed. There’s no way to know – meaning we need to be mentally and emotionally prepared for both possibilities. My team and I are well prepared.

Another thing we need to prepare for is the possibility of higher prices here at home.

Q: So, how will this war affect our own economy?

There’s no point beating around the bush: Consumer prices are already sky-high and are now likely to rise even higher.

Due to the pandemic, inflation has risen at a historic rate. New sanctions and supply-chain issues will only compound the problem. For that reason, it’s very possible we’ll see a jump in prices for the following goods and commodities:

- While oil prices and the price we pay at the pump aren’t the same, they are linked. On February 24 alone, oil prices rose above $100 per barrel.9

- Natural gas. As of this writing, prices are up 29% in Europe; we could see a similar rise.10

- Travel costs. Pricier oil means pricier jet fuel, which means higher airfares for travelers.

- As we’ve already covered, Russia and Ukraine are hugely important to the world’s supply of wheat, corn, and other staples.

- From your car to your cell phone, we rely on minerals and metals for our technology to function. Due to the pandemic, there was already a shortage of these supplies.

The U.S. can release oil reserves to combat rising fuel prices, and Europe can turn to other places for natural gas and wheat. (Including the United States.) But while these measures can help, they’ll take time – and can only blunt a rise in consumer prices, not stop it entirely.

Interest rates may also be affected. Most experts expected the Federal Reserve would soon announce significant rate hikes to combat inflation. In light of the invasion, interest rates will probably still go up, but might be less than previously thought. That’s good news for the stock market, at least in the short term, but it won’t help slow inflation as much.

Whew! I just threw a lot of information at you, didn’t I? Well, take a breath, grab a sip of water, get up and stretch your legs – and then let’s cover the fifth and final question.

Q: Given everything that’s going on, what should we be doing about it?

Prior to today, the idea of one European country invading another seemed almost unthinkable. It was something for the history books, not the front page. But that’s the world we woke up to today. A different world than the one we went to sleep to yesterday.

But here’s the thing to remember, |First Name|. The world is always changing – and we’ve always done a great job of adapting!

Massive change often triggers massive uncertainty. Massive uncertainty often triggers massive overreaction. That’s why so many investors tend to lose money during times of volatility, because they make long-term decisions based on short-term emotions under a fog of uncertainty. By acting without overreacting, you are literally doing the single best thing you can to stay on track to your financial goals.

The situation in Ukraine will likely change every day, hour, and even minute. Headlines you read in the morning might be obsolete by afternoon. That’s why it makes no sense when investors panic, sell, or “cash out” just because of uncertainty. By the time they do, the situation they’re reacting to may have already passed! So, my advice, |First Name| Over the coming weeks, let’s keep doing what we always do. Let’s keep our heads and hold to our long-term strategy. After all, we already know that it works!

I hope you found this message to be informative. Of course, please let me know if you have any questions or concerns about your portfolio. My team and I are here for you. We’ll keep monitoring the situation, and if anything changes, we’ll let you know immediately.

Sincerely,

Content That Moves and Inspires

With Presence, your clients and prospects will get heartwarming messages for every major holiday, including New Year’s, Martin Luther King Jr. Day, Valentine’s Day, Presidents Day, Mother’s Day, Memorial Day, Father’s Day, Independence Day, Labor Day, Thanksgiving, and Christmas. And we’re not talking basic “Season’s greetings!” emails. We’re talking stories and messages that inspire.

Messages that show you’re not just a good advisor, but a good person. Messages that get printed out, shared around the dinner table, or even read aloud in church. Messages that build trust.

Dear |First Name with Spouse|,

Merry Christmas! In honor of the season, I wanted to share a story I heard recently. To me, it perfectly illustrates what the Christmas season is truly about.

The year was 1952, and a young man named Virgil was very sick, and very far from home. That’s because he was a soldier in the Korean War.

Virgil had known much hardship that year. He’d endured freezing nights on sentry duty. He’d patrolled for miles in water-filled boots, hoping snipers couldn’t see him. He’d suffered concussions and persistent ear-ringing from artillery fire. He’d seen friends die.

But through it all, his mind always returned to one thing: His mother and two sisters. After his father died many years before, he’d taken care of them, filling the role of both elder brother and surrogate father. It had been almost two years since he’d last seen them, and he worried about them endlessly. His mother was getting older, and her health wasn’t always good. His first sister was working constantly, never having time to dance or do other things she loved. His second sister was lonely and scared and had nightmares that her brother wasn’t coming home.

Even when he’d spent a night pinned down by North Korean machine gun fire, with a bullet actually striking his helmet, he still worried about them. But the only way to communicate was by mail, and it could be months between letters. Sometimes their letters got lost in transit and didn’t arrive at all.

The only time Virgil didn’t worry was when he got sick. There was no time to worry. He was too busy shivering from a raging fever. Too busy vomiting up anything and everything the doctors tried to give him. Too busy being wracked with pain, a pain he’d never known was possible. Too busy watching the doctors discuss him in hushed tones, or check his vitals and frown, or look at lab results and shake their heads.

Too busy wondering why God wouldn’t just let him die so it could all be over.

But Virgil didn’t die. It took almost two excruciating months, but slowly, he felt the infection recede and his strength return.

By the time Virgil recovered, it was December. A few weeks before, he’d been airlifted to Japan to get better care. To help him recover, the Army granted him some extra R&R. So it was that he found himself spending Christmas in Tokyo. It was a long way from the small town he’d grown up in. As he took in the sights, Virgil passed by a shop window. Inside, on a rack, was the most beautiful set of embroidered silk stockings he had ever seen. That gave him an idea.

Virgil had grown up during the Great Depression. He’d seen his mother sell most of their belongings in order to put food on the table. Christmastime was the hardest. He and his sisters rarely got presents, and when they did, it was usually something that could be got at a flea market. And his mother never got anything all.

So, Virgil decided then and there to get his family Christmas gifts from Tokyo. For his mother, no more threadbare stockings, but silk stockings that would make her feel like a queen! For his oldest sister, a pair of beautiful slippers she could dance in. For his youngest sister, a gorgeous Japanese tea set she could play with to her heart’s delight. The Army had given him a little extra spending money, and he used it all, every cent. He pictured them opening their gifts on Christmas morning. Imagined their looks of delight, their audible gasps, the tears in their eyes. It made Virgil feel so warm inside, he thought that everything he’d just gone through would be worth it if it meant his family could have their greatest Christmas ever. Quickly, he bought the presents and paid to have them shipped. He included a little handwritten card with each, letting them know he’d recovered from his ordeal and wishing them a Merry Christmas.

A few months later, Virgil’s tour of duty ended. During the voyage home, he couldn’t stop thinking about his family’s gifts. He couldn’t wait to hear their stories of what it was like to open them. But when he finally arrived home, after hugging and kissing his family, he realized his gifts were nowhere to be seen. There was no tea set on the table, no slippers in the closet, no stockings in the drawer. His heart sank.

“What happened?” he asked. “Didn’t you get my gifts?”

“Of course we did,” her older sister said. And they showed him the cards he’d sent, carefully framed and placed on the mantle for everyone to see.

Then Virgil realized the packages had never arrived, only the cards. Heartbroken, he told them about the stockings, the slippers, and the tea set. He told them how he’d tried to make their Christmas the best ever.

That’s when his mother put her hands around his face. “My son,” she said, “the Army told us you’d been sick, and that you might not make it. But when we got your cards, we knew you were alive. We knew you would come home to us. It was the greatest Christmas gift we’ve ever gotten.”

That’s when Virgil realized the truth: Christmas had never been hard for his family, not in the way he had thought. Because Christmas wasn’t about opening presents or boxes under a tree. It wasn’t about silk stockings or other riches. It was about sharing a life full of love with your family. That is the real joy of Christmastime. That is the greatest gift of all.

|First Name|, on behalf of my entire team, I wish you and your family a safe and joyful holiday season. Merry Christmas!

Emails That Educate and Impress

These days, there are lots of digital marketing providers with educational material – but it’s all high on slickness and low on substance.

Our content – including market recap messages, infographics, social media posts, targeted email newsletters for pre-retirees, and more – not only educates but demonstrates that you are the premier expert in your field.

Dear |First Name with Spouse|,

Roughly one year ago, Congress passed the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act. It was a massive, $2 trillion stimulus package designed to help boost the economy as it shuddered from the impact of COVID-19. The bill was generally considered a success – but on its own, it wasn’t enough to keep the economy from falling ill.

The great tragedy of this pandemic, of course, is that over 500,000 people have lost their lives.1 But it’s not the only one. Due to COVID, over 22 million jobs were lost.2 Millions more saw their hours or paychecks decrease.

Fortunately, the CARES Act, and a second round of stimulus passed in December, helped blunt some of this pain. For example, the December stimulus is credited with helping retail sales jump 5.3% in January, which was five times higher than expected.3 But there is still a long way to go. As of early March, there are still nearly 10 million people out of a job, with 4.1 million of those considered “long-term unemployed”.2 That means they’ve been jobless for 27 weeks or more. Millions more still find it immensely difficult to make rent, pay off debts, or even buy groceries. As Jerome Powell, the chairman of the Federal Reserve recently said, “While the economic fallout has been real and widespread, the worst was avoided by swift and vigorous action. [But] the recovery is far from complete.”4

In short, our economy has been off life support for quite a while – but it is still a long way from healthy. With that in mind, Congress recently passed a third round of stimulus worth almost as much as the original CARES Act. It’s called the American Rescue Plan Act of 2021.

This is major legislation, with benefits for many Americans. So, to help you understand what the Act does, and how it will impact you, I have prepared a special breakdown. As I am sending this to all my clients, some information may apply to you, and some may not. Please read it carefully, and then let me know if you have any questions.

As always, |First Name with Spouse|, I hope you and your family are staying healthy and safe. Please let me know if there is anything I can do for you!

Sincerely yours,

Content Marketing That

Creates Opportunities

Ultimately, there’s one thing you want: More business.

Whether you want to target business owners or high-net-worth, Presence helps you get people to a “tipping point” where they decide it’s time to take action or get help with specially-crafted “Call to Action” messages that generate second opinion requests, reviews, and referrals. And from your existing clients, you might be surprised to find there are more assets to move under your management.

Dear |First Name|,

For many people, a 401(k) is the easiest and most convenient way to save for retirement. Unfortunately, many people don’t know as much about their 401(k) as they should. As a result, they aren’t getting as much out of it as they could.

To help, I’ve prepared a special infographic that lists five questions you should ask yourself about your 401(k). If you already know the answers, great! But if you don’t, it may be time for a review. If so, please don’t hesitate to contact me. I would be happy to offer a second opinion on how to get more out of your 401(k).

I hope you find this infographic thought-provoking. As always, please feel free to call us at «CompanyPhone» if there is anything we can do for you.

Sincerely,

How it Works...

With Presence, you get a carefully-calculated Financial Advisor Marketing Plan every quarter that details your content strategy. You can see what emails will go out each week. If you are on Presence +, you’ll be able to preview the letter we’ve chosen to send. And if we are also managing your social media platforms, we’ll tie it all together with posts that will continue to build brand awareness.

And these aren’t just marketing ideas that look interesting but produce no results. Thanks to our thirty years’ worth of building effective marketing strategies based on data and experience, we can segment your lists into an ideal target market, manage your subscribers, craft your subject lines, and schedule all your market recap messages, newsletters, infographics, feel-good holiday messages, and CTA messages (call to action) for their optimal time, ensuring the highest open rates, maximum clicks, best engagement, and greatest impact.

Whenever there is major volatility or critical news that could impact the markets, we will adjust your plan on the fly to get a special “handholding” message out to your email recipients within 24-48 hours.

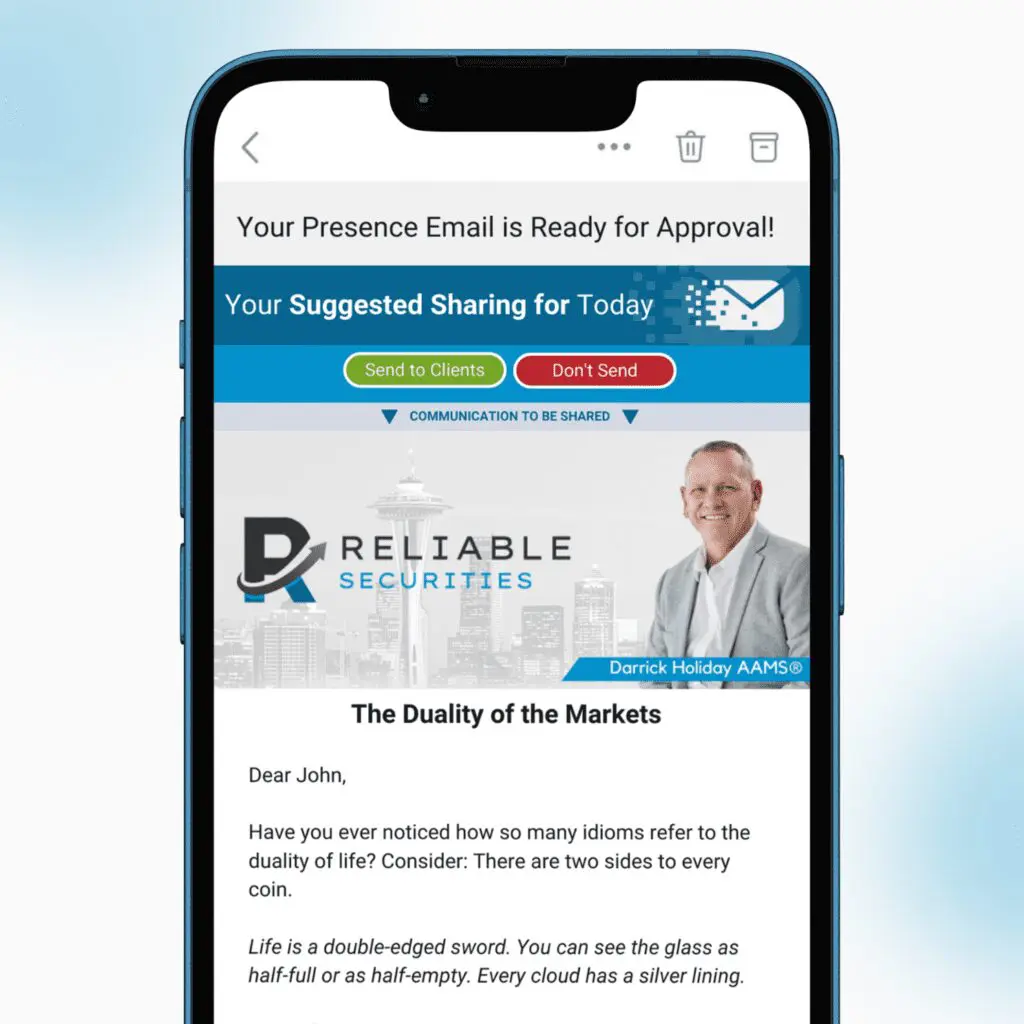

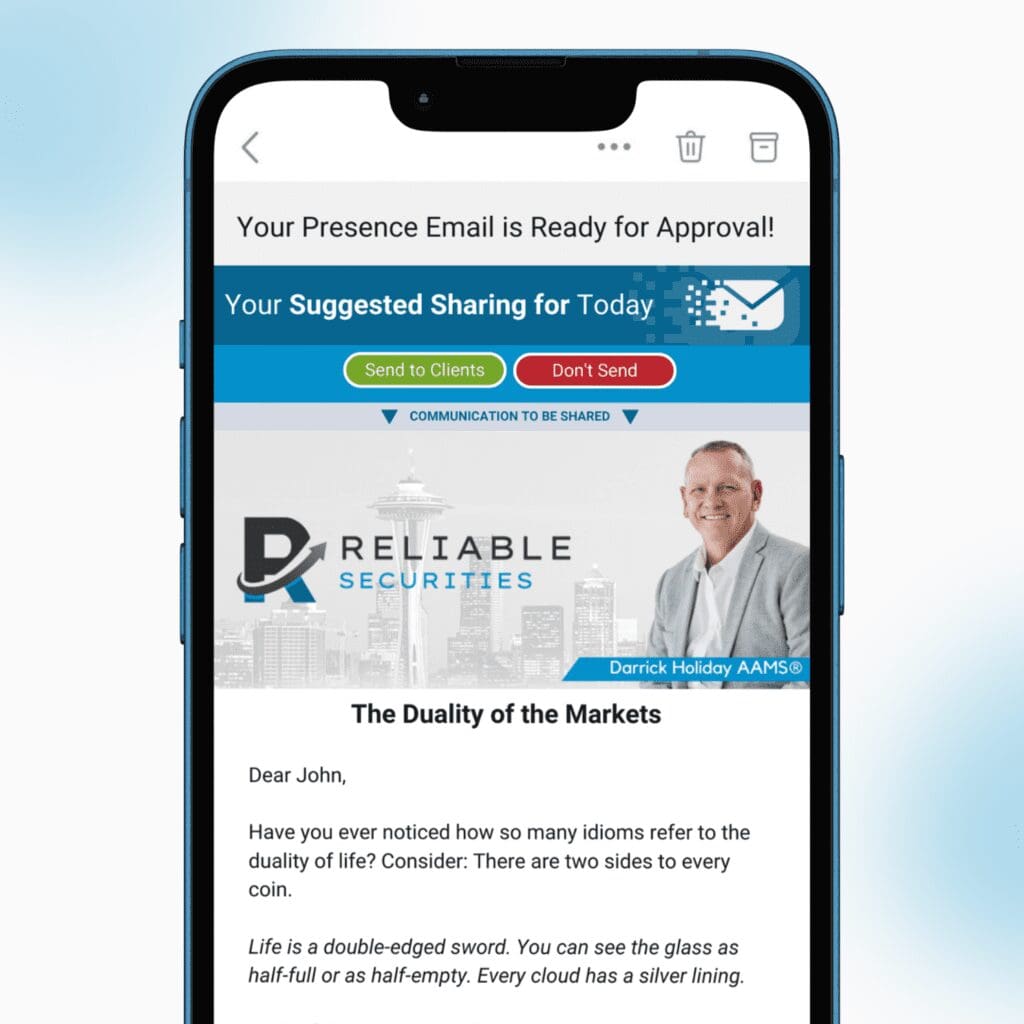

Stay Top-of-Mind with One-Click Approvals

Our service is “Done-for-You”, which means we create an effective marketing strategy that is designed to grow your business.

Then we implement it! We do all the planning, design, and delivery so all you have to do is click and approve. If you need to make any changes, that’s really easy too!

Track Your Marketing Results with Ease

We keep tabs on how your campaigns are performing, digging deeper into metrics and conversion rates to make smarter decisions for your future email marketing efforts. In addition, you will have access to the reporting you need to view the results of each campaign. In this way, we can ensure your lead generation efforts are bringing in what you need to grow your business at the pace you want.

“Bill Good Marketing contains the best collection of content in one place.

The special event messages are a big hit with my clients!

Using them definitely saves me time, as I would never be able to write all the messages that Bill Good has given me!”

W.K. | South Carolina, USA

Maximize Your Marketing ROI with Presence

Unlock substantial savings by bundling our email, social media, and direct mail services. Contact us to discuss bundle offers tailored to your needs.

*Exclusive discounts available for our BGM clients; If you are a member of the BGM System be sure to contact our team.

Presence

Done-For-You Email Marketing

$4200

/year - plus $150 setup

Experience the power of cutting-edge email marketing without lifting a finger. Let us do the heavy lifting, so you can enjoy a stress-free journey to increased engagement and conversions.

- 4 emails sent per month

- Built-in compliance assistance

- Customized email template

- CRM integrations

- True peace of mind

*Price per Financial Advisor

Presence +

Done-for-You Email + Direct Mail

$6700

/year - plus $350 setup + postage

Unlock the potential of impactful direct mail campaigns without the hassle. We take care of every detail, ensuring you a seamless route to tangible results and satisfied clients.

- Everything included in "Presence"

- Fully-managed direct mail

- Customized mailing templates

- Proven strategies for engagement

- True peace of mind

*Price per Financial Advisor

Social Media (Add-On)

Done-for-You Social Media

$2400

/year - plus $100 setup

Dive into the world of engaging social media content without the daily grind with Presence. Entrust us with the crafting and posting, and watch your online presence soar stress-free.

- 6-8 posts per month

- Built-in compliance assistance

- Branded social media content

- 2 social channels of your choice (additional channels extra)

- True peace of mind

*Price per Financial Advisor

[All-in-One] Presence

[Email] + [Direct] + [Social] Presence

$9100

/year - plus $450 setup + postage

Seamlessly harness the power of social media, direct mail, and email marketing.

We manage every detail, all while you enjoy the growth stress-free.

- Fully-managed direct mail

- Fully-managed email marketing

- Fully-managed social media

- CRM integrations

- True peace of mind

*Price per Financial Advisor

Presence

Done-For-You Email Marketing

$375

/month - plus $500 setup

Experience the power of cutting-edge email marketing without lifting a finger. Let us do the heavy lifting, so you can enjoy a stress-free journey to increased engagement and conversions.

- 4 emails sent per month

- Built-in compliance assistance

- Customized email template

- CRM integrations

- True peace of mind

*Price per Financial Advisor

Presence +

Done-for-You Email + Direct Mail

$575

/month - plus $500 setup + postage

Unlock the potential of impactful direct mail campaigns without the hassle. We take care of every detail, ensuring you a seamless route to tangible results and satisfied clients.

- Everything included in "Presence"

- Fully-managed direct mail

- Customized mailing templates

- Proven strategies for engagement

- True peace of mind

*Price per Financial Advisor

Social Media (Add-On)

Done-for-You Social Media

$200

/month - plus $100 setup

Dive into the world of engaging social media content without the daily grind with Presence. Entrust us with the crafting and posting, and watch your online presence soar stress-free.

- 6-8 posts per month

- Built-in compliance assistance

- Branded social media content

- 2 social channels of your choice (additional channels extra)

- True peace of mind

*Price per Financial Advisor

[All-in-One] Presence

[Email] + [Direct] + [Social] Presence

$775

/month - plus $600 setup + postage

Seamlessly harness the power of social media, direct mail, and email marketing.

We manage every detail, all while you enjoy the growth stress-free.

- Fully-managed direct mail

- Fully-managed email marketing

- Fully-managed social media

- CRM integrations

- True peace of mind