Top 3 Investment Advisor Prospecting Hurdles & Solutions

Presumably, you are reading this article because you’re interested in financial advisor prospecting. So, before we do anything else, let’s define what prospecting actually is.

Navigating the world of LinkedIn can be quite an adventure for financial advisors. Think of it as your digital playground, where connections, influencers, and prospects mingle. It’s not just about throwing your name out there; it’s about crafting a presence that resonates with LinkedIn users, turning your profile into a lead generation powerhouse. Imagine having conversations with prospects right from your desk, leveraging tools like Sales Navigator to sift through the noise and find those golden opportunities. And hey, let’s not forget the magic of LinkedIn messaging – it’s like having coffee with a potential client, but in the digital world!

Now, let’s chat about making the most of how you use LinkedIn as a social media platform. It’s more than just posting updates; it’s about engaging, sharing insights, and, yes, even becoming a bit of an influencer in your own right. With each post, comment, or shared article, you’re laying down another brick on your path to professional growth. And for those of you who are already familiar with LinkedIn but want to up your game, think of this as fine-tuning your strategy. Using LinkedIn effectively means being smart with your interactions, using Sales Navigator to zero in on prospects, and crafting messages that don’t just sound like another sales pitch.

Ready to dive in?

Let’s turn that LinkedIn profile into a thriving hub for networking, lead generation, and so much more with “From Connection to Client: A Financial Advisor’s Guide to LinkedIn.”

After setting the stage on why LinkedIn is an indispensable tool, let’s delve into optimizing your profile to stand out in a sea of suits. Your LinkedIn profile is like your online storefront; it needs to be inviting, clear, and reflective of you and your brand.

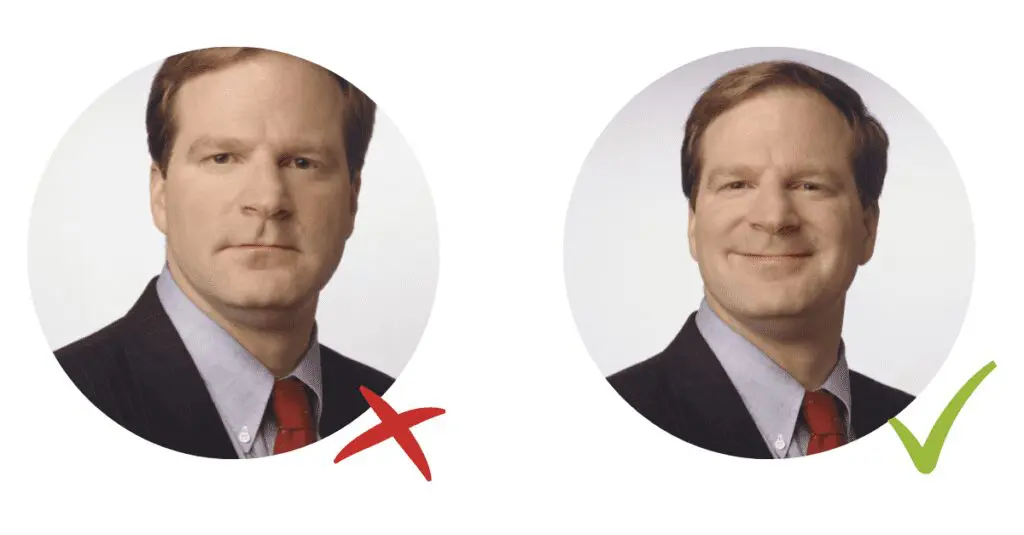

Step one in LinkedIn’s glow-up is to revisit that profile picture. This isn’t just a picture; it’s your digital front door, welcoming committee, and first impression all rolled into one. In the financial advising universe, first impressions are like stock prices — they really matter. A crisp, professional photo is like a firm handshake in pixel form.

When selecting your profile pic, consider these elements:

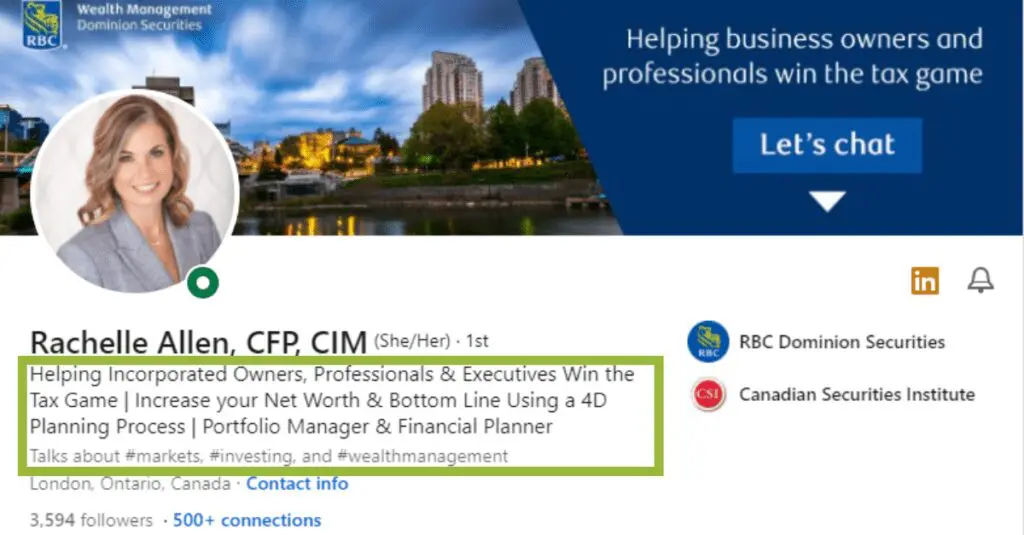

The header image is prime real estate on your LinkedIn profile. It’s the billboard that speaks volumes about your brand and professionalism. A custom header with a Call to Action (CTA) isn’t just visually appealing; it directs connections on what to do next. It could be visiting your website, booking a call, or reaching out for a consultation.

For example, check out this advisor’s custom header below:

Here are some technical specifics for creating an effective header image:

Think of your LinkedIn headline as your personal billboard on the busiest digital highway. It’s not just a job title; it’s a neon sign flashing your professional story. This little line of text is your golden opportunity to succinctly tell the world who you help, how you help them, and why you’re the superhero compared to the rest of the suits.

Imagine your headline as the catchy hook of your favorite song – it’s got to be memorable, concise, and punchy.

Consider this formula: [Job Title] + [Target Market] + [Value You Provide].

For example, “Financial Advisor Helping Young Professionals Achieve Financial Independence.” This approach immediately informs visitors who you are, who you serve, and the value you bring.

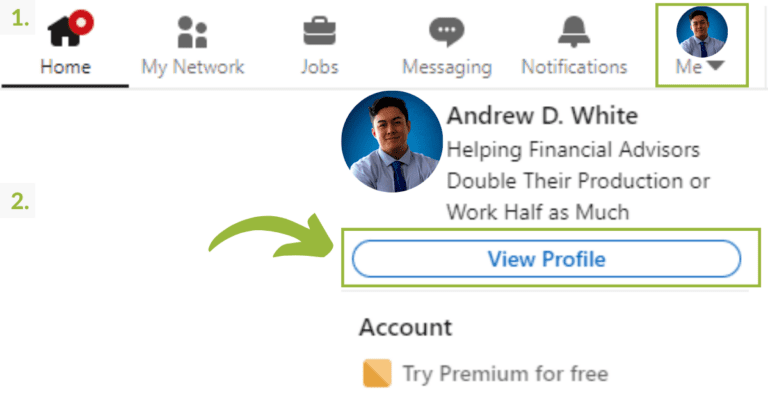

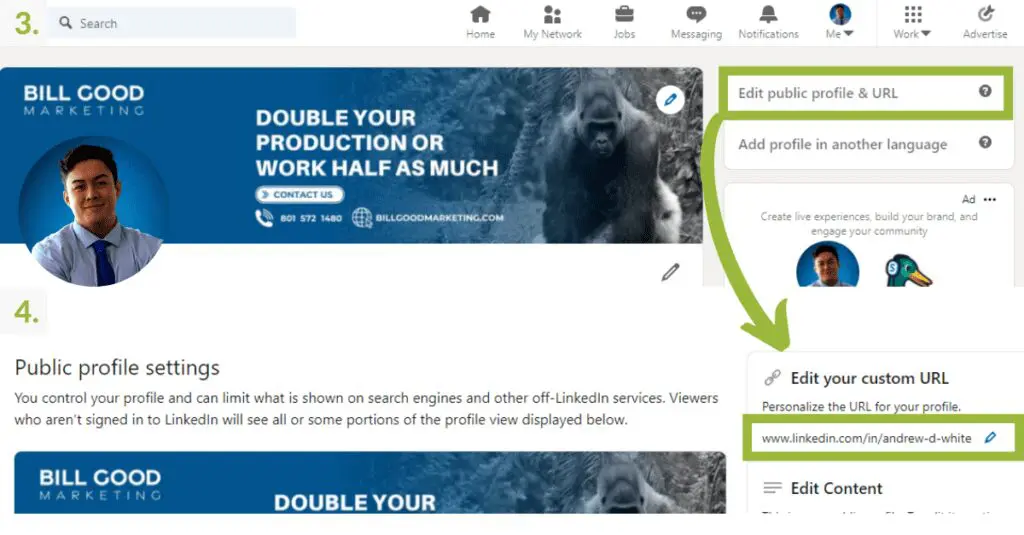

A customized LinkedIn profile URL is like having a personalized business card ready to hand out. It enhances your professional image and makes it easier for people to find and remember you. A URL that includes your name and, if possible, your professional designation, sets you apart from the crowd and boosts your searchability both on LinkedIn and search engines. It’s the LinkedIn equivalent of wearing a tailored suit in a room full of off-the-rack fits.

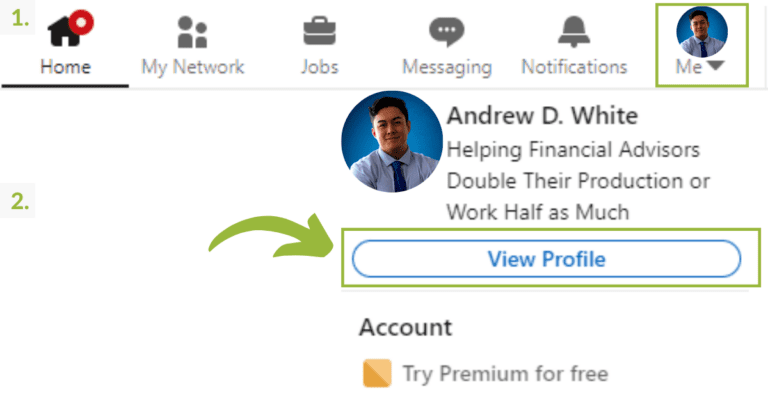

To customize your URL:

By following these steps, you’re not just optimizing your LinkedIn profile; you’re setting the stage for more meaningful connections, better visibility, and, ultimately, a stronger professional presence in the financial advisory world. Let your LinkedIn profile shout from the rooftops about your expertise, professionalism, and the unique value you bring to the table.

Moving beyond the visual elements of your LinkedIn profile, the next crucial step for financial advisors is to master the art of storytelling in your summary and experience sections. This is where you transform from a two-dimensional profile into a three-dimensional professional, offering a rich narrative of your expertise, values, and services in the world of financial planning and wealth management. We’ll start with your summary…

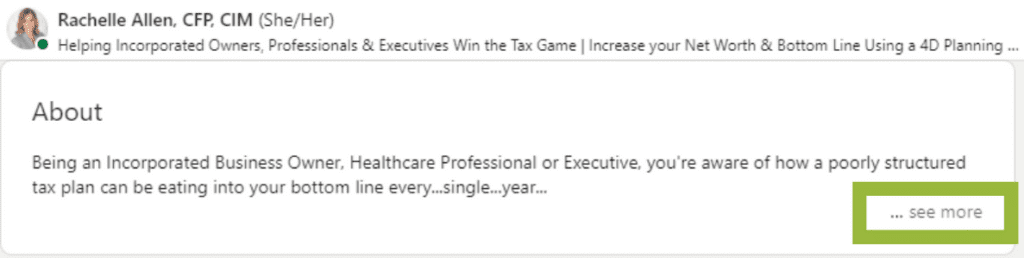

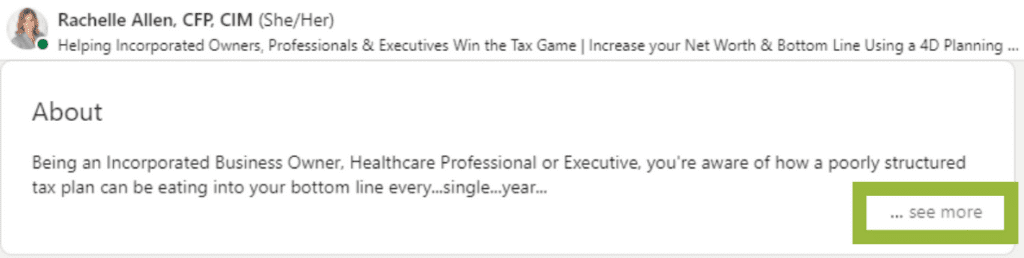

The opening of your LinkedIn summary should be as captivating as the opening line of a best-selling novel. It’s your elevator pitch; you have just a few seconds to grab the attention of your audience.

Start with a powerful statement or a compelling question that reflects your professional ethos and approach. For example, “Are you looking to navigate the complex world of financial planning with ease? I’m here to guide you.”

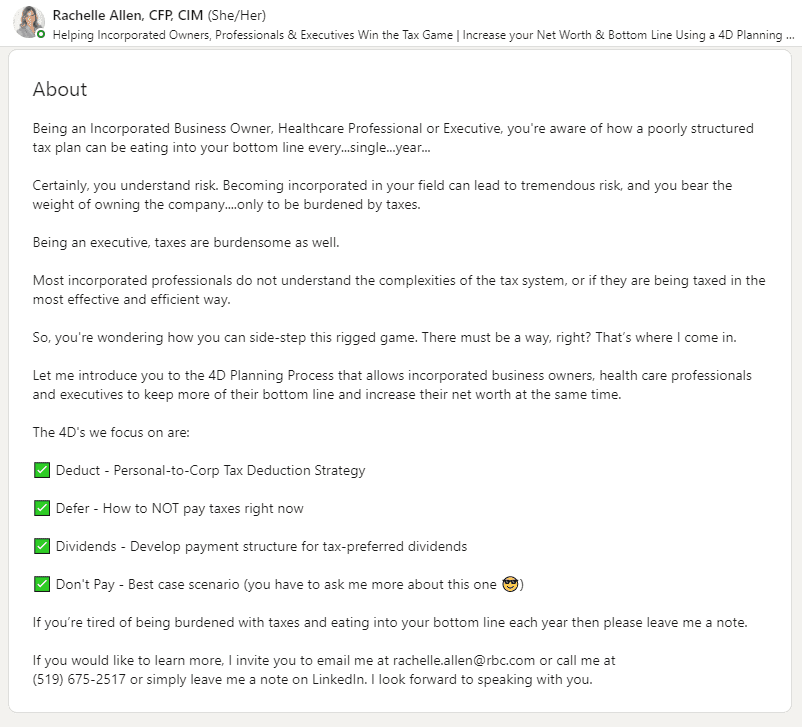

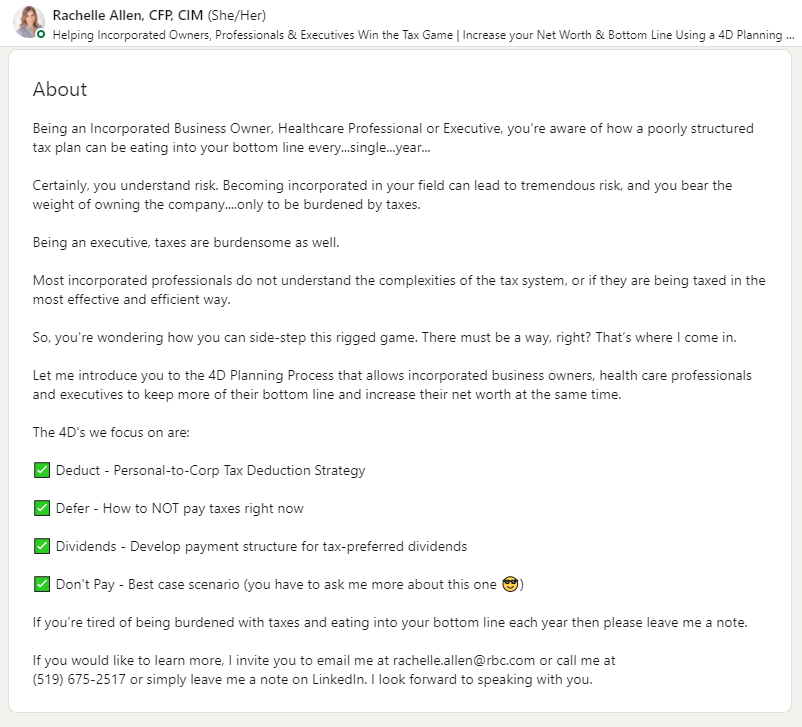

Take a look at this advisor’s summary. She writes a powerful statement that not only relates to her profile headline but also creates enough curiosity to click ‘SEE MORE.’

After a strong start, your summary should tell the story of your career in financial services. This is your opportunity to showcase your expertise and how you can help your clients with their financial goals. Remember, write in the first person to create a personal touch.

Here are our LinkedIn tips to help your summary:

The Experience section is your professional timeline as a financial advisor, a place to detail your journey in the industry. Here, you can expand on your roles, responsibilities, and achievements. Use bullet points for clarity and highlight key milestones.

Incorporating these elements into your LinkedIn profile not only enhances your visibility but also positions you as a knowledgeable and approachable expert in financial planning. Your summary and experience sections are not just about what you’ve done; they’re about who you are as a financial advisor and how you can be the key to your clients’ financial success.

Remember, in the world of LinkedIn for financial advisors, your profile is your digital handshake. Make it count!

Now that we have established a strong foundation for your LinkedIn profile, let’s focus on boosting your visibility and engagement. This is where you actively shape your personal brand as a financial advisor and solidify your status as a thought leader in your field. It’s not just about who you know but also who knows you.

The Featured section of your LinkedIn profile is a dynamic space to highlight your most important content. It’s the perfect place to showcase your expertise and services in a way that’s immediately visible to visitors.

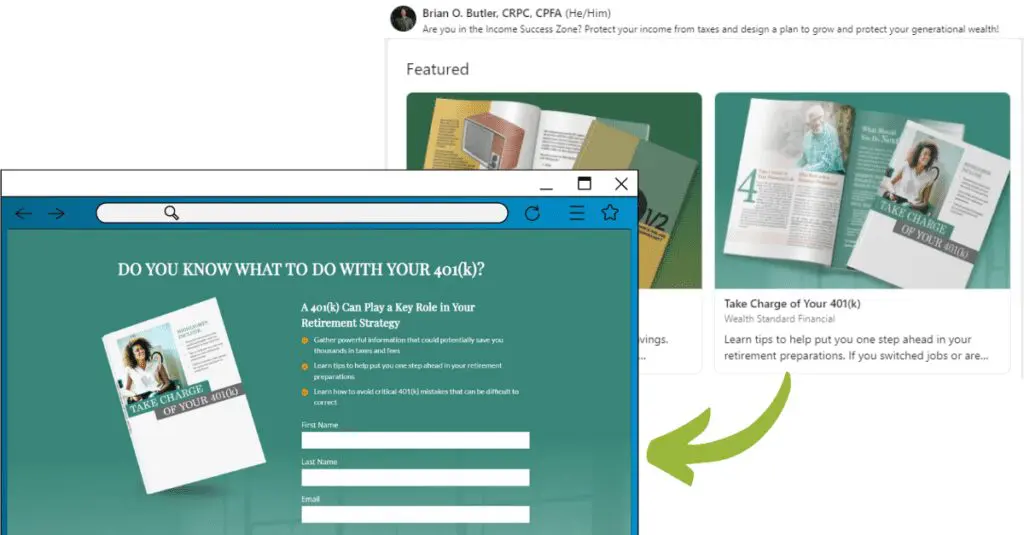

Check out this advisor’s featured section. He directs any profile visitors to download two different free eBooks, capturing their contact information in the process.

Building and maintaining connections is crucial. Each connection request is a potential doorway to new opportunities. Personalize your connection requests with a brief note on why you wish to connect, making it more likely to be accepted.

LinkedIn groups are a goldmine for networking and staying abreast of industry trends. Join groups relevant to financial advisors, financial planning, and wealth management.

Finally, keep an eye on your metrics. LinkedIn provides analytics that can help you understand what content resonates with your audience. Use this data to refine your strategy and continue building your presence on the platform.

By enhancing your visibility and engagement on LinkedIn, you’re not just building a professional network; you’re establishing a community around your personal brand as a financial advisor. This proactive approach can lead to meaningful connections, potential clients, and a strengthened position as a thought leader in the financial services industry.

Alright, let’s get personal – not in a nosy neighbor kind of way, but in a savvy financial advisor understanding their clientele sort of way.

Knowing who you’re talking to on LinkedIn can make a world of difference.

Now, let’s shift gears to referrals and client acquisition. Think of LinkedIn as your virtual coffee shop where conversations can lead to new business opportunities.

SEO and automation might sound like tech buzzwords, but they’re actually your allies in the digital marketing realm.

Remember, succeeding on LinkedIn for financial advisors is not just about being active; it’s about being actively engaged in a way that’s authentic and personal.

It’s about understanding and speaking directly to your audience, crafting messages that resonate, and using the smart tools at your disposal to stay on top of your game. So, dive into those demographics, get personal in your outreach, and let automation and SEO be your silent partners in this digital journey.

Keep it real, keep it you, and let’s make your LinkedIn profile not just a page but a reflection of your professional passion and personality.

As you venture through the dynamic world of LinkedIn and digital marketing, it’s crucial to have a guide that understands the intricate dance of online networking and brand building. This is where Bill Good Marketing comes into play. With over 40 years of expertise in the industry, we’re not just observers; we’re seasoned professionals in enhancing your digital presence. From crafting impactful social media marketing strategies to fine-tuning your SEO, from hosting engaging webinars to managing effective practice management tactics, we’re here to elevate your online persona. Our commitment extends to providing you with a state-of-the-art CRM system, ensuring that every interaction with your clients is tracked, organized, and leveraged for maximum impact.

Navigating the nuances of LinkedIn and digital marketing for financial advisors requires more than just technical know-how; it demands a personal touch and a deep understanding of your audience. At Bill Good Marketing, we believe in the power of authenticity and personalized marketing strategies for financial advisors. We’re dedicated to helping you tailor your messages to resonate with your target audience, ensuring that your personal brand as a financial advisor shines through. Whether it’s through engaging webinars, insightful podcasts, or your daily interactions on LinkedIn, we’re here to support you in reinforcing your reputation as a trustworthy, knowledgeable, and approachable financial expert.

Reflect on your LinkedIn journey and the vast opportunities it presents in the world of financial advising. It’s more than just a professional platform; it’s a thriving community for growth, learning, and connection.

With Bill Good Marketing by your side, you’re equipped to refine your strategies, stay true to your brand, and enjoy the journey of building a robust digital presence. We’re here to ensure that your LinkedIn profile and digital marketing efforts are not just seen, but truly noticed and admired.

Andrew is a digital marketing expert here at Bill Good Marketing. Before joining Bill Good Marketing, Andrew spent most of his previous work experience in the digital marketing realm helping small businesses with things such as Web Design, SEO, and Social Media Management.

Presumably, you are reading this article because you’re interested in financial advisor prospecting. So, before we do anything else, let’s define what prospecting actually is.

Cold-calling is NOT a “try it once and hope it works” endeavor. It requires testing and tweaking to learn what works for your market, your list, and for you. Cold-calling is NOT for advisors who fear rejection. You will get a lot of rejections when you cold call – but if you follow best practices, it won’t matter, because the number of new leads you…

Staying on top of the best keywords for your business is essential for effective SEO. As we’ve discussed, these keywords help connect your website with the people who are searching for the services you offer. Based on insights from Google’s Keyword Planner, here are the 46 most relevant keywords for financial advisors…

When Neil McPeak Jr. — CFP®, CEPA® — joined his father’s practice fresh out of college, he was given one instruction: Learn to prospect. In other words, want to manage your own assets? Go out and find them yourself. (That wasn’t on his college curriculum…

HNW clients. You want ‘em. Everyone wants them. And you’ve likely gotten a dozen emails this month alone on how easy it can be to get more. But whether you’ve been in this industry for 1 year or 30, you know the truth…

Are you ready to unlock the formula that skyrocketed a Texas advisor’s AUM by 900%? Join us for an exclusive, one-time webinar revealing the strategies Mark Trice used to transform his $14M practice into a $134.4M business…